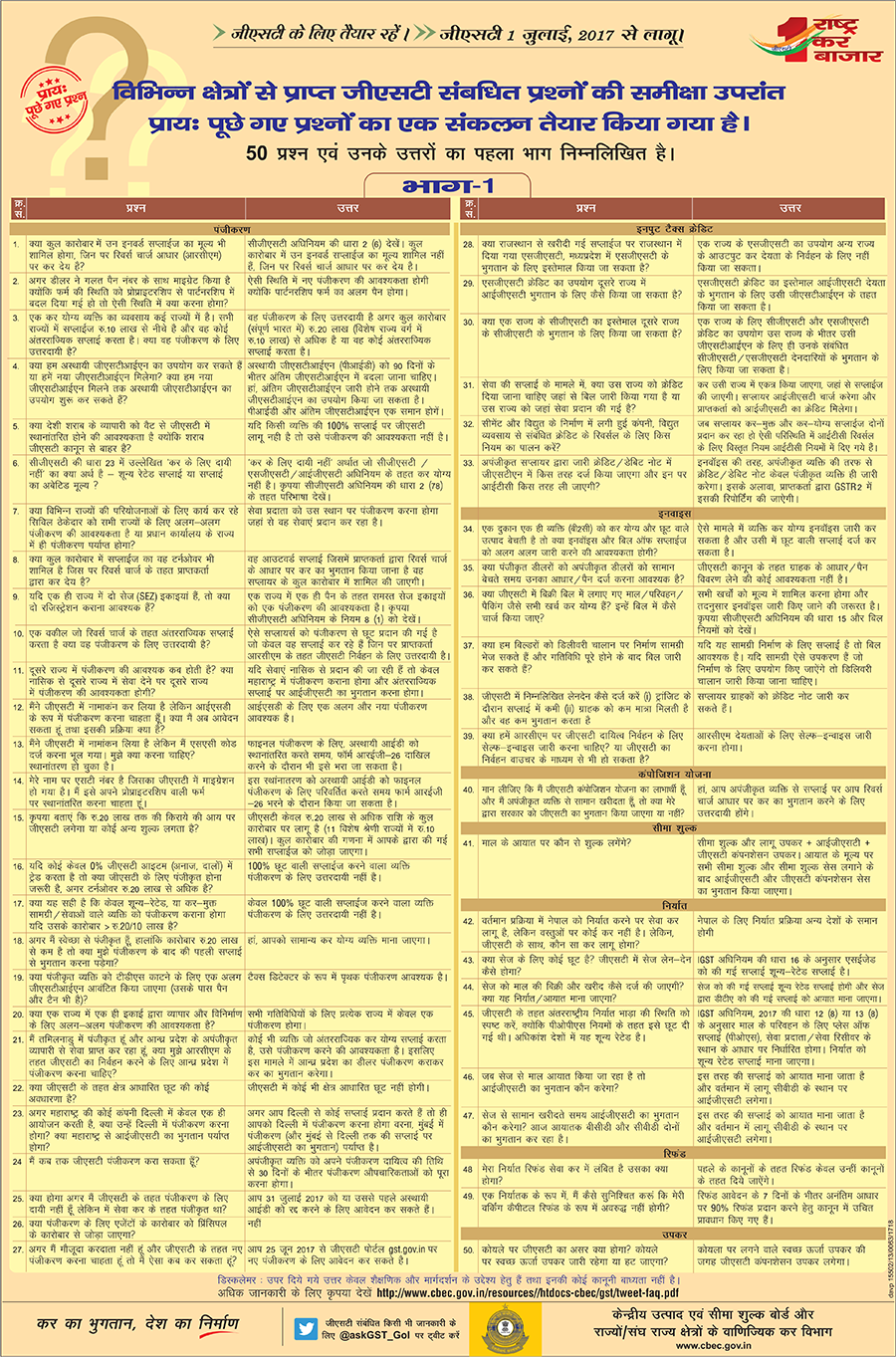

Goods And Services Tax Act 2017 In Hindi

15 of 2017 chapter v.

Goods and services tax act 2017 in hindi. Short title extent and commencement. The union territory goods and services tax act 2017 no. Central goods and services tax act 2017. 2 it extends to the whole of india except the state of jammu and kashmir.

The constitution one hundred and first amendment. An act to make a provision for levy and collection of tax on intra state supply of goods or services or both by the central government and for matters connected therewith or incidental thereto. The goods and services tax gst act 2017 came into force from 1st july 2017. Gst determination of value of supply rules 2017.

1 1 this act may be called the central goods and services tax act 2017. 2 it extends to the whole of india except the state of jammu and kashmir. The jammu and kashmir state legislature passed its gst act on 7 july 2017 thereby ensuring that the entire nation is brought under a unified indirect taxation system. The goods and services tax compensation to states act 2017 no.

Goods or services or both by the central government and for matters connected therewith or incidental thereto. Com law and practice. 1 this act may be called the central goods and services tax act 2017. Be it enacted by parliament in the sixty eighth year of the republic of india as follows chapter i preliminary 1.

Comptroller means the comptroller of goods and services tax appointed under section 4 and includes for all purposes of this act except the exercise of the powers conferred upon the comptroller by section 5 2 a deputy comptroller or an assistant comptroller. Here is a list of the major changes proposed in gst bill applicability of gst law in the state of jammu and kashmir j k j k finance minister haseeb drabu has confirmed that j k will apply gst. Gst registration rules 2017. 3 it shall come into force on such date as the central government may by.

The central goods and services tax act 2017. 3 it shall come into force on such date as the central government may by notification in the official gazette appoint. Board means the goods and services tax board of review established under section 50. An act to make a provision for levy and collection of tax on inter state supply of goods or services or both by the central government and for matters connected therewith or incidental thereto.

1 this act may be called the central goods and services tax act 2017. However since j k continue reading major amendments in goods and services tax act 2017. Gst input tax credit rules 2017. A digital ebook.

After the enactment of various gst laws goods and services tax was launched all over india with effect from 1 july 2017. 14 of 2017 chapter iv.