Goods And Services Tax Gst Registration

You only need to register for gst once even if you operate more than one business.

Goods and services tax gst registration. Check gst return pay good and service tax gst filing and takes the help of gst registration consultant. Login to gst portal. Your business or organisation has an annual gst turnover of 75 000 or more. Gst is a tax added to the price of most goods and services including imports.

Goods and services tax. Goods and services tax gst. You pay this to the australian taxation office ato when it s due. This is called standard gst registration.

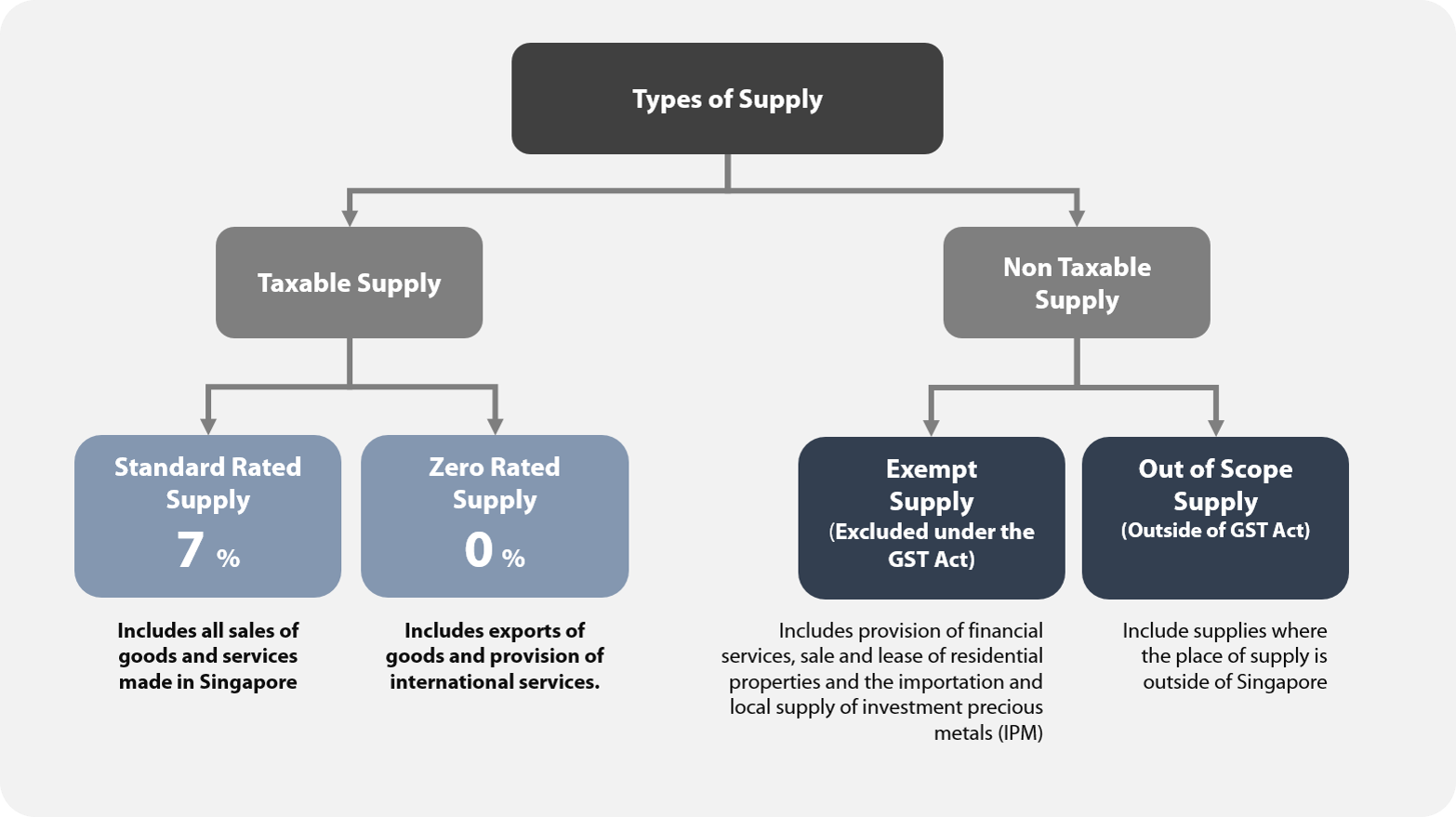

Goods and services tax gst is a tax of 10 on most goods services and other items sold or consumed in australia. You can register for goods and services tax gst online by phone or through your registered tax or bas agent when you first register your business or at any later time. Lodge your grievance using self service help desk portal. What it is and how it works goods and services tax or gst is a broad based consumption tax levied on the import of goods collected by singapore customs as well as nearly all supplies of goods and services in singapore.

If your business is registered for gst you have to collect this extra money one eleventh of the sale price from your customers. Welcome to gst registration. Get your business new gst registration online from the gst official registration website. Tax darpan tax consultant d b sarani bally howrah kolkata west bengal india.

In other countries gst is known as the value added tax or vat. Gst is charged at a rate of 15. Your non profit business or organisation has an annual gst turnover of 150 000 or more. You receive fares for transporting passengers by taxi or limousine e g.