Goods And Services Tax Network Comes Under Which Act

6 act 2017 act no.

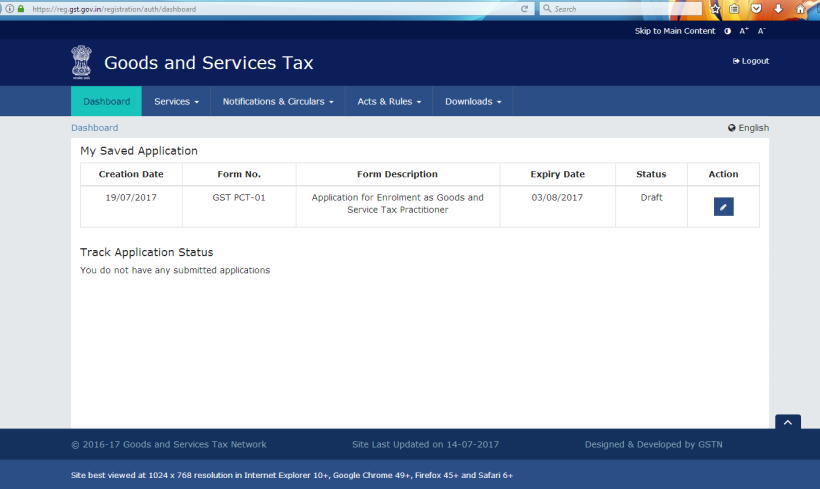

Goods and services tax network comes under which act. Besides some goods and services would be under the list of exempt items. An act about a goods and services tax to implement a new tax system and for related purposes. Tax slabs are decided as 0 5 12 18 28 along with categories of exempted and zero rated goods for different types of goods and services. Goods and services tax practitioners.

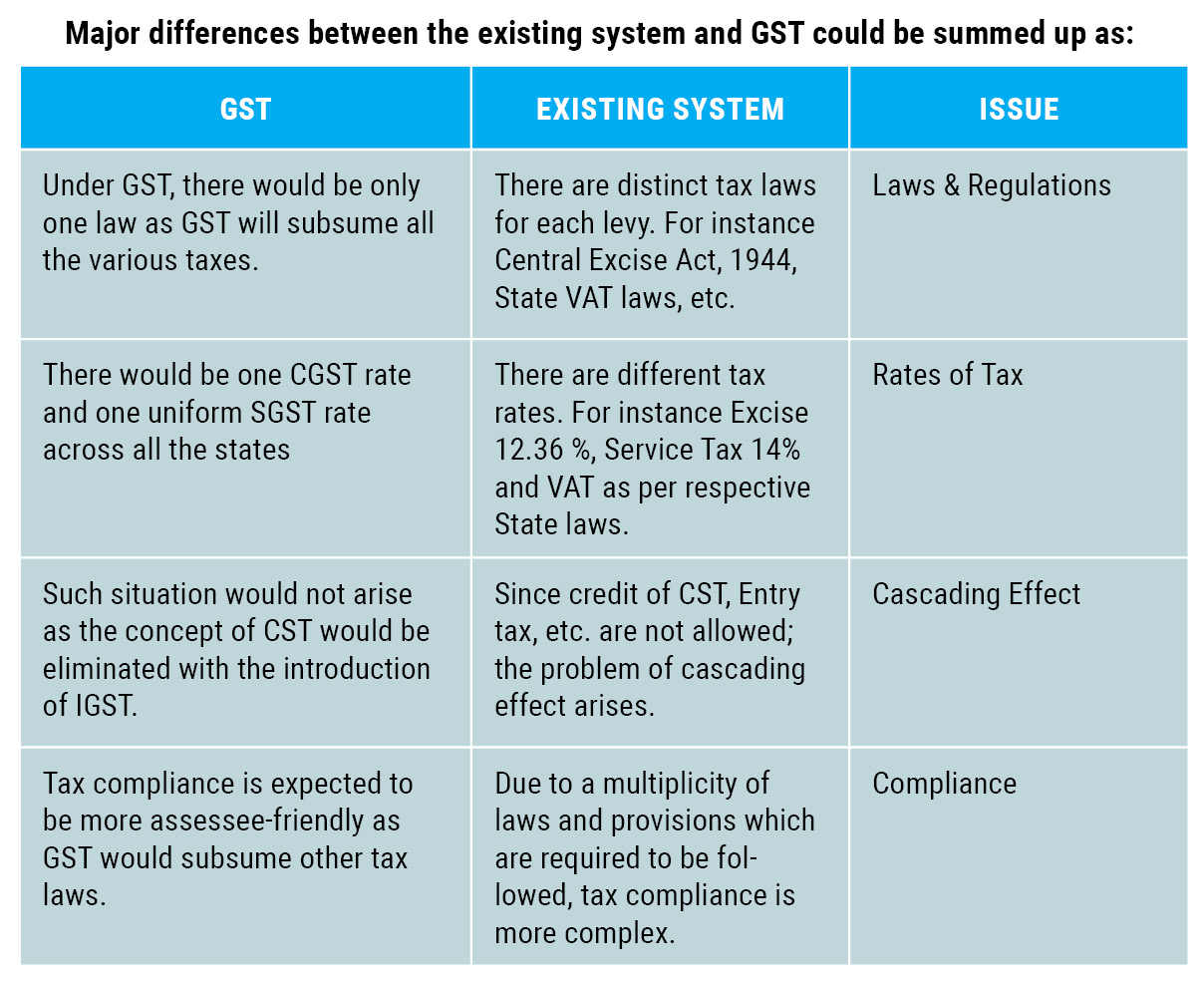

Section 2 1 additional tax. This compilation is affected by retrospective amendments. Repealed on 26 july 1996 applying with respect to tax obligations liabilities and rights that are to be performed under or arise in relation to supplies made in respect of taxable periods commencing on or after 1 april 1997 unless necessary for the enforcement of other provisions in this act by section 2 1 of the goods and services tax amendment act 1996. 12 of 2017 12th april 2017 an act to make a provision for levy and collection of tax on intra state supply of goods or services or both by the central government and for matters connected therewith or incidental thereto.

Gstn goods and services tax network. Please see the treasury laws amendment 2017 measures no. Utilisation of input tax credit subject to certain conditions. The exempted services has been finalized except services supplied by goods and services tax network which is the addition to the list of exempted services under service tax regime.

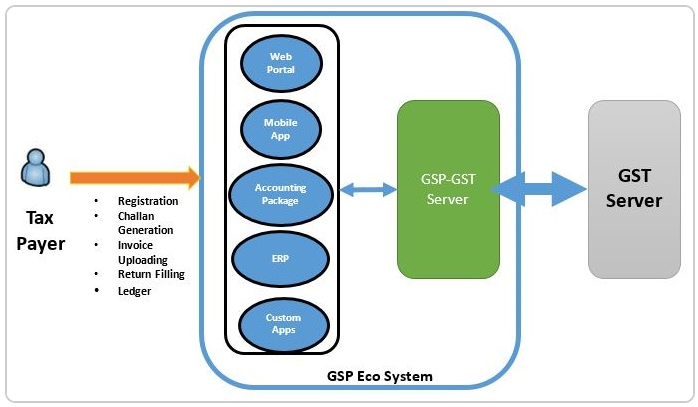

Goods and services tax network gstn is a nonprofit organisation formed for creating a sophisticated network accessible to stakeholders government and taxpayers to access information from a. Order of utilisation of input tax credit. Goods and services tax network gstn the gstn software is developed by infosys technologies and the information technology network that provides the computing resources is maintained by the nic. Tax deduction at source.

22 of 2005 15th june 2005 an act to provide for setting out the practical regime of right to information for citizens to secure access to information under the control of public authorities in order to promote transparency and accountability in the working of every public authority the constitution of a central information commission and state. The goods and services tax compensation to the states bill 2017 the compensation bill. Be it enacted by parliament in the sixty eighth year of the republic of. Interest on delayed payment of tax.

And a state gst will be passed by the respective state legislative assemblies. Payment of tax interest penalty and other amounts. The central goods and services tax act 2017 no. The tax rates for different goods and services have been finalized.